Twin Cities MN Housing Market

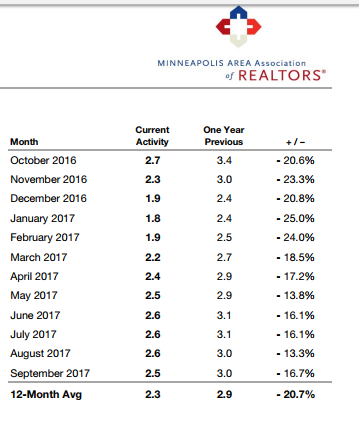

The inventory of homes for sale hit an all time low in early 2017.

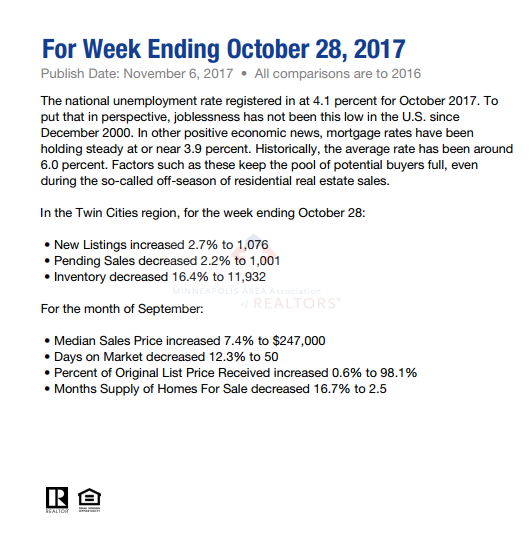

Twin Cities median home sale prices have been steadily climbing since 2011, with the average year-over-year growth for the last 12 months at 7.4% for October 2017. Inventory of homes for sale in October 2017 is 16.4% below last year, an even bigger year-over-year drop than last year. Days on market decreased 12.3%… still a strong seller’s market but weakening demand is starting to set in... buyers are getting fatigued by a lack of inventory.

Where it stops being a seller’s market and shifts to the benefit of buyers is in price ranges over $500,000… which is great for move-up buyers. If you are thinking about making a move and selling a home under $500k to buy a home over $500k you have the best of both worlds… selling in a seller’s market and buying in a buyer’s market.

One level townhomes continue to be in shortest supply, as downsizing Empty Nesters leave their houses in search of fewer maintenance responsibilities and more freedom to travel… sometimes moving closer to children and grandchildren.

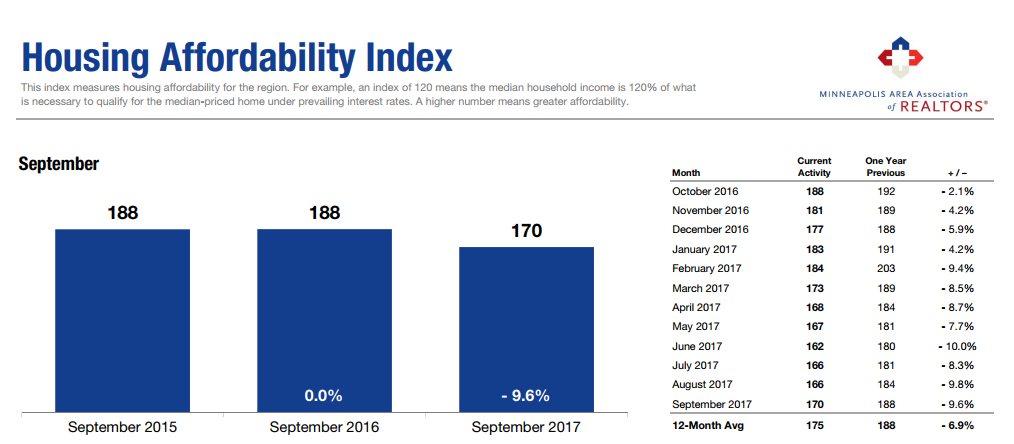

Affordability is a growing concern.

The figures/charts above are based on statistics for the combined 16-county Twin Cities metropolitan area released by the Minneapolis Area Association of Realtors.

Check out the March 2017 Twin Cities Housing Market Update for comparison.

************************************************

Twin Cities Housing Market Update for Centennial, Mounds View, White Bear Lake school districts.

Home Inventory Stats for school districts: 0012,0621,0624,0832 Contact Sarah for details and interpretation.

We all know that real estate is LOCAL. Call Sarah to discuss the market in your local area.

Ready to check out what’s happening in YOU neighborhood? Get your hyper local, customized real estate market report HERE.

Nationally speaking:

The NAR expects 2018 sales up a solid 3.7%, to 5.67 million units. The median home price should be up 5.5% this year and next. Some fret over affordability. But recently, both the Urban Institute and the First American Real House Price Index found affordability historically high. And last week, mortgage data firm Black Knight reported "affordability in most areas, while tightening, remains favorable to long-term norms." The CEO of real estate data firm CoreLogic explained, "A strengthening economy, healthy consumer balance sheets and low mortgage interest rates are supporting the continued strong demand."

Related Information:

- Getting the Maximum Appraisal Value for Your Home

- How can I Sell Faster and For More Money?

- Real Estate Gimmicks

- What Happens When You Request Property Information Online