Twin Cities Housing Market at a Glance

According to the press release from the St Paul Area Association of Realtors on March 15, 2017, Twin Cities home prices continued to rise in February, and demand remained strong. Buyer activity continued to outpace seller activity, culminating in relatively quick sales and low supply. The low inventory situation and affordability crunch has been particularly hard on first-time buyers struggling to get into the market.

- New Listings in the Twin Cities region decreased 7.5 percent to 5,418.

- Pending Sales were up 0.5 percent to 3,969.

- Inventory levels fell 25.3 percent to 8,820 units.

- The Median Sales Price increased 7.6 percent to $223,000.

- Days on Market was down 14.6 percent to 82 days.

- Months Supply of Homes for Sale was down 28.0 percent to 1.8 months.

- New Construction Permits were up 18.5% to 339.

- New Construction Permitted Units were up 93.3% to 717

One proposed solution is the First-Time Home Buyer Savings Account Act (HF1234/SF888), proposed by the

Minnesota Association of REALTORS, along with the Builders Association of the Twin Cities. The First-Time

Home Buyer Savings Account Act would allow individuals to save up to $5,000 per year with a tax deduction. (

See the story on Kare 11.) Visit the Minnesota Homeownership Initiative website to help advance the legislation and take action.

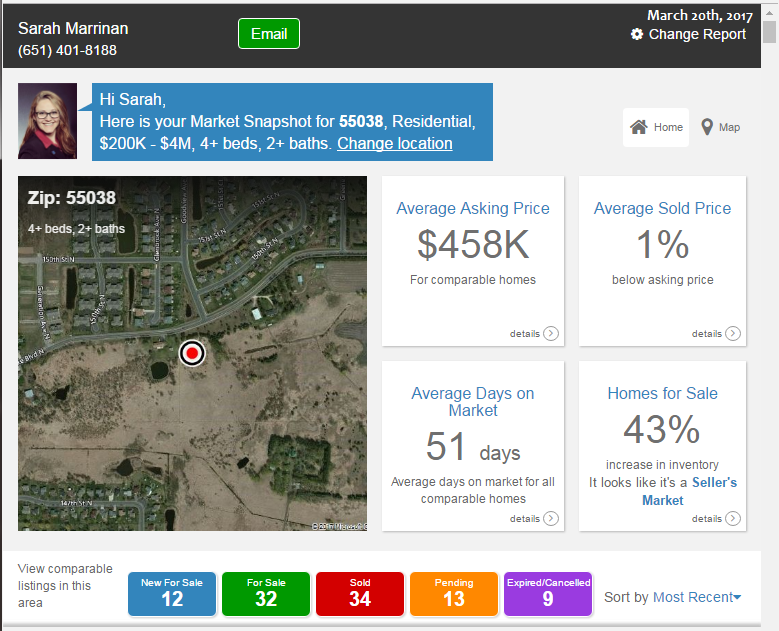

Of course, this is a metro-wide real estate report and we all know that real estate is LOCAL.

Ready to check out what's happening in YOU neighborhood? Get your hyper local, customized real estate market report HERE.