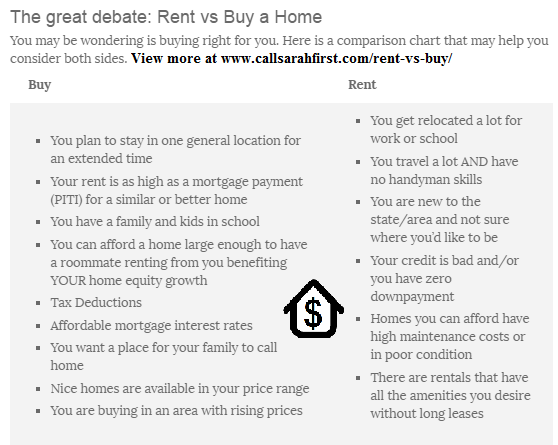

The great debate: Rent vs Buy a Home

You may be wondering is buying right for you. Here is a comparison chart that may help you consider both sides.| Buy | Rent |

|

|

Renting vs Buying a Home In the News:

August 8, 2016 -Trulia's latest Rent vs. Buy Report explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.January 25, 2016 - Buy or rent? Zillow CEO shares real estate tips

September 22, 2015 -According to the latest Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, home ownership is a better way to produce wealth, on average, than renting.

View a Buying vs Renting Calculator from Realtor.org (Assuming you will not have a roommate renting from you.)

Share this rent vs buy chart:

Purchasing a Personal Home vs Rental Property

What a home to be an investment?To ensure you purchase the best real estate, you need to know what qualities make for a good investment property.Related: Where to Buy Real Estate for Higher Value...

Effective After Tax Rate.

This is important for helping people fully understand the huge value of home ownership.

Let’s use a calculation of an average appreciation of a home at 4.5%

If the client has a mortgage of 3% and is in a 24% Income Tax Bracket: Take 100-24 (24 being the Income tax bracket) = 76.

76 x .003 = 2.28. The Effective after tax rate is then 2.28%.

Deeper drill down of this example: If I own a $400,000 valued home and it is appreciating at 4.5%, then next year it would be valued at $418,000.

4.5 - 2.28 = 2.22 If we then take the $400,000 x 2.22% it is a $8,880 net gain. That is a gain of $740 per month!

Of course there are other costs associated with owning a home like property taxes & insurance but we all need shelter! Also keep in mind that while one is making a payment, the principal balance is going down and there is additional equity gained.

Bottom line is that homeownership is a great way to build wealth and there are many studies that can show that.