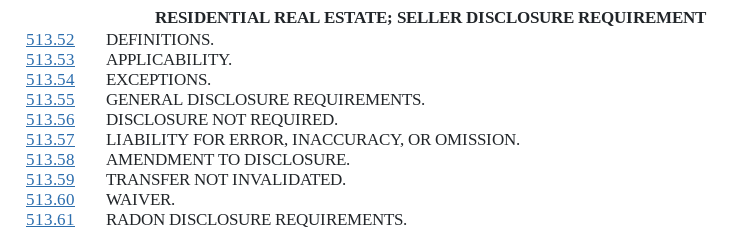

Home Seller Disclosure Requirements in Minnesota

I can't provide any legal advice about how a home seller should disclose but here is what 2018 Minnesota Statutes chapter 513 says about property disclosures. (Statutes are laws that apply to all citizens and cover a variety of topics, including the following: the Legislature, the executive branch, state departments, the judiciary and courts, tax policy, public safety and police authority, towns, cities, counties, commerce and trade, private property and private rights, civil injuries and remedies, and crimes against people and property and the penalties associated with them.)

513.53 APPLICABILITY.

The seller disclosure requirements in sections 513.52 to 513.60 apply to the transfer of any interest in residential real estate, whether by sale, exchange, deed, contract for deed, lease with an option to purchase, or any other option.

2018 Minnesota Statutes

513.55 GENERAL DISCLOSURE REQUIREMENTS.

Subdivision 1.Contents.

(a) Before signing an agreement to sell or transfer residential real property, the seller shall make a written disclosure to the prospective buyer. The disclosure must include all material facts of which the seller is aware that could adversely and significantly affect:

(1) an ordinary buyer's use and enjoyment of the property; or

(2) any intended use of the property of which the seller is aware.

(b) The disclosure must be made in good faith and based upon the best of the seller's knowledge at the time of the disclosure.

Subd. 2.Disclosure to licensee.

A seller may provide the written disclosure required under sections 513.52 to513.60 to a real estate licensee representing or assisting the prospective buyer. The written disclosure provided to the real estate licensee representing or assisting the prospective buyer is considered to have been provided to the prospective buyer. If the written disclosure is provided to the real estate licensee representing or assisting the prospective buyer, the real estate licensee shall provide a copy to the prospective buyer.

513.57 LIABILITY FOR ERROR, INACCURACY, OR OMISSION.

Subdivision 1.No liability.

Unless the prospective buyer and seller agree to the contrary in writing, a seller is not liable for any error, inaccuracy, or omission of any information delivered under sections 513.52 to 513.60 if the error, inaccuracy, or omission was not within the personal knowledge of the seller, or was based entirely on information provided by other persons as specified in section 513.56, subdivision 3, and ordinary care was exercised in transmitting the information. It is not a violation of sections 513.52 to 513.60 if the seller fails to disclose information that could be obtained only through inspection or observation of inaccessible portions of the real estate or could be discovered only by a person with expertise in a science or trade beyond the knowledge of the seller.

Subd. 2.Liability.

A seller who fails to make a disclosure as required by sections 513.52 to 513.60 and was aware of material facts pertaining to the real property is liable to the prospective buyer. A person injured by a violation of this section may bring a civil action and recover damages and receive other equitable relief as determined by the court. An action under this subdivision must be commenced within two years after the date on which the prospective buyer closed the purchase or transfer of the real property.

Subd. 3.Other actions.

Nothing in sections 513.52 to 513.60 precludes liability for an action based on fraud, negligent misrepresentation, or other actions allowed by law.

Visit https://www.revisor.mn.gov/statutes/cite/513

{{emailsignature}}